Once a month, I share with 904 other Millennials a brief newsletter highlighting the best tips about money I've read.

Join Us!

How to Make Your Money Work For You If You’re a Millennial

Financially Well

August 15, 2021

The sooner you figure out how to make your money work for you, the less savings you’ll need to contribute over time

On this episode of Financially Well, the finance podcast for Millennials, we’ll explain how to make your money work for you. Specifically, we’ll discuss the role that time plays in investment success. In short: the sooner, the better in most cases.

Go Big, Then Stop

I want to highlight today a recent article that Nick Maggiuli wrote. He writes a blog called Of Dollars and Data. His article, which was published on July 27, is called, “Go Big, Then Stop.” Nick writes about a savings and investment philosophy that he says, “Can help you to build wealth for decades, while you literally do nothing.”

Why You May Struggle to Lean How To Make Your Money Work For You

First, though, I want to put his ideas and data into context. I specifically want to reference my experiences with Millennials who reach out to me for financial planning. We may have in-depth conversations about savings and investments, but ultimately they want me to say, “Here’s how to make your money work for you.”

The reason Nick’s ideas resonate with me is based on the experiences I’ve had with other millennials. I often hear from people who feel stuck. Many people around my age, especially in the high-income Washington, D.C. area, have a decent amount in their savings accounts. They understand at some some level that they want to make that money work. So they ask me, “What steps can we take to responsibly shift some of these dollars from our savings account to an account that may earn a higher return?” But the trade-offs in making that decision aren’t easy. First, Millennials need to think through their emergency funds. Do they have enough saved for an unexpected life event, such as a medical expense, a home repair project, or even something happening to their car? They also may need to consider student loan payments. How much cash do they need accessible to keep on top of that debt? Then there are all of the other things that can come up in life. For some Millennials, that may include travel or just making sure you have enough excess cash to navigate the different expenses that come with having kids.

The Stress of Draining Your Savings Account

Ultimately, my peers are asking me, “What can we do to make our money work for us?” It’s stressful. People often fear the worst-case scenario. And they view that scenario as worse than the status quo, especially if that investment is locked away in a retirement account. In that case, it’s not as accessible to them. To access it, they would have to pay a penalty to withdraw those funds. Or, in a brokerage account, they might invest the money and then need it at a time when the stock market is not in a good place.

The millennials who are asking these questions are smart. They’re doing the right thing trying to make sure they stay on track for retirement and other long-term financial objectives they may have. But they’re hesitant about the best ways to make this happen. What steps should they take? When should they do it? How long do they need to do it for? These are all the questions that they have. And they are not easy to find answers to.

When You Feel Behind on Investing

The context for Nick’s article that is most relevant for this discussion is what do you do if you haven’t invested as much as you might like. You’re an adult on your own. You’re generating your own income. You’ve been paying your own bills for some period of time. Yet, you feel like, looking back, you haven’t invested as much as you might have liked. There are many good reasons why this may be the case. I mentioned student loans previously. That’s that’s a very common one for young adults in their 20s and 30s. People who are trying to save for a down payment and want to buy a house are another group. There are all these different reasons why people may not be putting as much into their retirement accounts as they otherwise would. Or, these are the main reasons why they aren’t just investing in a taxable brokerage account to be able to access that money without penalty at some point in the future.

What if You’ve Missed Opportunities to Make Your Money Work For You?

Many Millennials feel like they’ve missed five years of investing. Some older Millennials may have missed 10 years of solid investment contributions. How can these people make the most optimal decisions at this point in life? As a starting point, they may need recognize and accept that, ideally, they would have liked to do things differently when they were younger. Nick’s article focuses on the implications of this reality. He points out the difference between someone who starts investing, essentially, right after college. The people who get their first full-time job and first paycheck. They may have their first 401(k) plan or other employer-provided retirement plan, and they have this opportunity to invest. He compares people in those circumstances to the people that I described previously. The people who, for a number of different circumstances, feel they need to wait several years take similar investment steps.

It’s critical to recognize that there are very good reasons why not everyone can invest as much as they might like when they’re 23. So what can those people do when they’re 33 or 37? The important message, which I’ll touch on at the end of the article discussion, is that it’s never too late. Even if there’s something you wish you could have done. Even if you regret certain financial or investing decisions you made when you were younger. It’s never too late to get on the right track to retirement. It’s never to late to turn to investing to help make your long-term goals possible.

Over the Long-Term, You Can Make Your Money Work For You Without Much Effort

But here’s what I value about Nick’s article. Nick’s work and focus in this article is on financial and investment data. He uses that information to analyze what is the most effective or optimal strategy for most people. He says, based on his research, that ideally, you “save as much as you can, as early as you can, then if you want, you stopped saving altogether.” In other words, as the article headline suggests, “go big, then stop.”

It’s clear, based on the data we have, that there’s a tremendous benefit in starting early when you invest. For people who are just out of college or early in their careers, there’s a really significant benefit in starting early. Even people who are much later to this option, but want to get started and get on a better investment trajectory, you can benefit. And you can benefit no matter what the dollar amount is.

How to Start Investing, No Matter Your Circumstances

Ideally, you have your budget in a good place and you’re able to save some amount for an emergency fund. When you start investing, you also want to make sure you’re keeping up with the other aspects of your finances. Then, initially, you put some amount, no matter how much, into some type of investment. You could choose a tax-advantaged retirement account or a taxable brokerage account that you might plan to access earlier than retirement. Starting early, even with small dollar amounts, can have significant benefits for you over the long term. The effect of compounding is that strong. The money that you contribute initially grows. Then, future growth is based not just on your contributions, but also on the growth that’s already taken place. Nick writes that, “If we assume that markets compound by some positive rate each year, on average, then money invested earlier will grow to more than money invested later.”

When you’re just out of college or grad school, it can be confusing and stressful to figure out how you’re actually going to make investing work. If you’re living in a high-cost city like Washington, D.C., rent is expensive. Or if you’re trying to save for a down payment, purchasing a home is expensive. Under these circumstances, investing may feel like a very difficult task, especially to save anything meaningful for retirement. But even those small amounts benefit from compounding. Even those small amounts gradually help you to achieve what Nick emphasizes — many times, investing earlier is better than waiting and investing later.

Investing Early vs. Investing Later, in Numbers

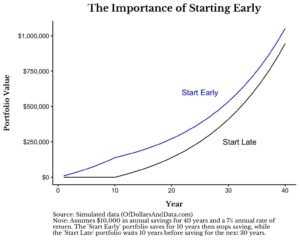

Nick gives a hypothetical, but tangible example in his article, as shown below. He describes someone who commits to saving for the first 10 years of their career, and then never saving again. He calls this the person who starts early. The other person in his example will wait 10 years to start investing, but then save every year for the next 30 years. This is the person who starts late.

Nick assumes that they both save $10,000 a year. While saving, they earn a 7% return on their money. He asks, “Who ends up with more wealth after 40 years?” As you may guess, based on what I talked about above, that it’s that person who saved for their first 10 years, and then didn’t save again. That’s how meaningful and impactful compounding is for your investments. That’s how early investing can change your long-term wealth and financial stability.

Nick says that the larger your annual return (which we can’t control or predict), the more costly it is to delay your savings. Since we don’t know what the stock market will do, we want to take whatever productive steps we can to be on track for retirement. In other words, you want to make your money work for you as quickly as you can, even if it’s in small amounts. Then, if you get to a point where you’re earning more money or just feel more comfortable managing your finances, you can make the amounts larger.

The Details of How To Make Your Money Work for You

This is how I believe it’s most useful to conclude this discussion. Don’t strive for perfect. And that pursuit of “perfect” can take place in different ways. Nick talks about one problem at the end of his article. Some people can get obsessive with this idea. When you understand the benefits of compounding and starting early with your investments, you may say, “I’m going to spend so little money. I’m going to invest the vast majority of my take home pay. I’m just going to live a very frugal lifestyle for the first 10 years of my life.”

On paper, if the stock market does reasonably well, you will indeed grow your investments by a significant amount over time. But are you actually living your life? Are you actually taking advantage of prime years to travel? Are you social, especially before your life changes in certain ways after marriage or kids? What else can you be doing with your time and money to make the most of those first 10 years? Nick points out that you don’t want to go to the extreme with this example. With any potential financial opportunity, balance is important. In this case, it’s balancing how early you invest with actually living your life.

Waiting to Invest Until You Have Full Control

Pursuing perfection also can be problematic if you wait until you feel like you have full control over your finances. Some people may wish to wait until they have a certain amount of money, whether it’s $500 or $1,000 a month. Whatever that “ideal” amount to start investing may be in your mind. That’s another example where you likely will do more harm than good over the long term. Instead, work with you have right now. Try to invest that small amount on a regular basis. Then, over time, focus on how you can steadily increase that contribution over time. Let’s say you are contributing 10% of your salary this year. Next year, try to bump that up to 11%. When you do this, you’re always making your money work for you in some form. You are doing something positive for yourself and your long-term financial situation.

Consistent, but Incremental Investment Progress

For many people, one goal here is to make sure that you achieve as much financial wellness as possible when you’re older. And when you steadily increase your savings, you’re getting close to that goal in a sustainable way. Investing then rarely feels so daunting in the moment that you stop doing it or feel totally stressed. With this approach to investing, you’re focused on consistency and incremental progress. Any Millennial, even those who feel like they’re behind on retirement or feel like they haven’t done enough, can take these steps. If you do so over the long term, you’ll likely be on track for retirement. And you can rest easier knowing that you are making your money work for you.

Support Nick Maggiuli and check out his article at Of Dollars and Data. Again, it’s called “Go Big, Then Stop.”

[Editor’s note: this article reflects the transcript (which I’ve edited for clarity) of a recent Financially Well podcast episode.]

About Kevin Mahoney, CFP®

Kevin Mahoney, CFP® is the founder & CEO of Illumint, a Washington, D.C.-based company that offers financial planning for Millennials. He specializes in navigating the new financial decisions that arise during our late 20s and 30s, such as repaying student loans, buying a house, & investing savings. Kevin also works as a financial wellness program provider to millennial employees around the country, including group speaking engagements.

Kevin Mahoney, CFP®

About Me

You may regret a few of your past financial choices. But it’s rarely too late to change your retirement setup, starting with a Roth conversion

Sports gambling companies rely on complexity to make money. But complexity also exists in personal finance.

When you invest in index funds, you’re not here for entertainment. You’re just playing to win the game through the smartest route possible.