Hi, I'm Kevin. I write a free newsletter about money for 904 other Millennial parents. We talk about how to turn your money into memories.

Join Us!

Will a Home Bias in Investing Limit Your Potential Wealth?

Financially Well

October 1, 2022

Our preferences for things with which we’re familiar creates a home bias when we invest our savings

Comedian Daniel Tosh once started a show:

“It is great to be here in America. The greatest country in the world!

…If you haven’t traveled a lot.”

He continued, “Do we have to constantly scream we’re #1? It’s always the people who live in the most boring parts of a country who scream the loudest. …Have you ever seen a photo of Fiji? I’ve never been to Fiji, but I’ve seen photos, and it looks pretty amazing. It’s hard to think we’re better than that.”

Welcome back to Financially Well, the finance podcast for Millennials.

What Causes Home Bias in Investing?

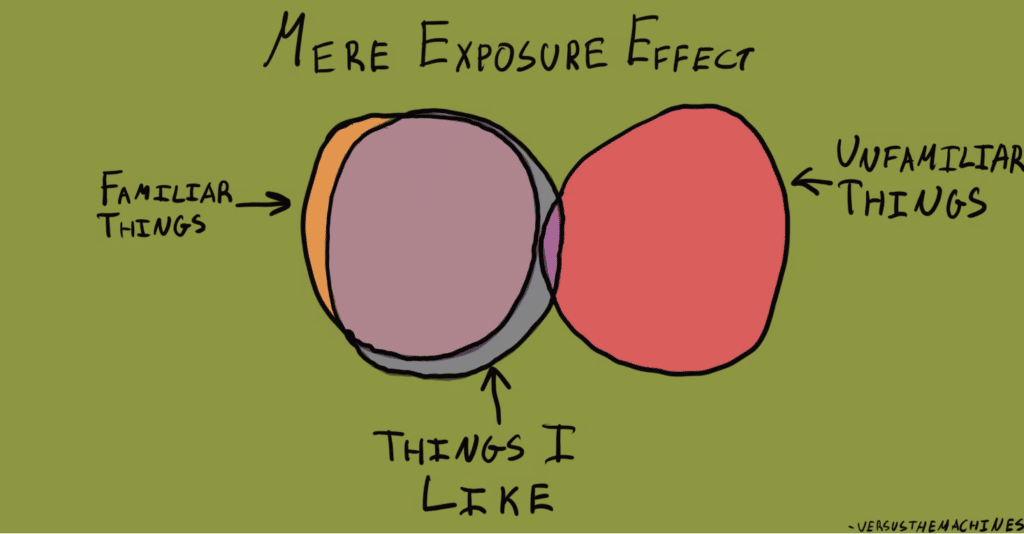

Tosh’s joke hits on a psychological bias to which we’re all vulnerable. It’s called the mere exposure effect. This bias, according to The Decision Lab, describes our tendency to develop preferences for things simply because we’re familiar with them.

And a recent academic study highlighted how often the mere exposure effect can impact our financial decisions.

NPR reported earlier this month that “Yale financial economist James Choi rummaged through 50 of the most popular books on personal finance to see how their tips square with traditional economic thinking.”

His analysis covered saving, budgeting, housing, and investment decisions. I’ll share the full academic paper in the show notes for this episode. Right now, though, I want to focus on one particular personal finance topic that Choi studied. He talked about investing in international stock markets, particularly the home bias that prevents us from doing so.

Learning About Investing Through a Money Mad Libs Exercise

As part of this discussion, I want to introduce a sort of money mad libs exercise. How would you complete the following sentence?

Investing in _________ (now insert a noun) makes me feel _________ (and insert an adjective here).

Investing your savings in the stock market requires a certain level of confidence and bravery. Essentially, you’re surrendering your hard-earned money to complex, uncertain forces.

Given this reality, you’re likely to latch onto anything that will help you feel just a bit more at ease with the system. And familiarity checks this box.

When you choose to invest in a U.S. index fund, you allocate your money among hundreds of companies. So your fortunes become tied to many popular brands that you already know: Google, Amazon, Walmart, Home Depot.

Sure, you may still feel a little nervous about subjecting your savings to stock market fluctuations. But familiarity acts as a distraction. Your home bias can help you feel a little less daunted. And perhaps a little more hopeful and proud about your investing decisions.

So for me, I might initially write that money mad lib to say: Investing in companies I know makes me feel prudent.

How Home Bias in Investing May Limit Our Potential Wealth

Those positive feelings, however, can quickly morph into anxiety and FOMO. Familiarity turns into unnecessary risk if it plays too large of a role in your investment decisions.

Why?

Because the U.S. stock market isn’t always your best investment option. Of course, over different periods of time, the U.S. stock market does grow at a faster rate than international stock markets. In fact, we’re currently living through this scenario.

But on average, going back to 1975, such “outperformance” only lasts for 7.9 years. And that’s the point at which you begin to wish you had given the world’s many other stock markets a chance. It happened between 2000-2009, for example. During that time span, an index fund composed of companies in emerging and developed [international] markets beat the U.S.’s S&P 500 Index seven times.

So I might adjust my money mad lib to read: Investing in countries I’ve never visited makes me feel vulnerable.

Should You Invest in International Stock Markets?

This historical market data brings me back to James Choi’s study. Here’s NPR summarizing how economists think you should invest:

“Economic theory stresses the importance of…diversifying the countries you invest in. Theoretically, the more countries you invest in, the less risky your investment portfolio will be. Some countries will do well. Others will do poorly. “So,” Choi says, “Economic theory would say you want a diversified portfolio that holds a bit of every country’s stock market in the world.”

Thanks to index funds, “diversification” has become a more common financial term. But has anyone ever given you Choi’s specific advice? For many of you, I imagine the likely answer is “no.”

Choi’s research suggests that may be due to personal finance writers suffering from the same home bias that you do. In fact, NPR reports that the “invest at home” blind spot isn’t limited to the U.S. “The French are more likely to invest in French companies. The Japanese are more likely to invest in Japanese companies, and so on.”

Investing in _________ (now insert a noun) makes me feel _________ (and insert an adjective here).

Overcoming Home Bias in Investing with Help

None of us can entirely escape familiarity bias. But you also don’t need to overcome this human shortcoming on your own.

Several financial institutions offer an index fund that includes both U.S. and international stock markets. At Vanguard, for instance, the Total World Stock Index Fund contains a mix of U.S. and foreign companies that largely reflects the composition of the global economy.

And most of the “target date” funds that you’ll find in your company retirement plan include international companies in their investment mix. Forty-two percent of the Fidelity Freedom target date fund, for example, is invested in non-U.S. stocks.

Ultimately, I invest in the stock market to grow my family’s savings as much as possible. So I’m not opposed to learning about how the home bias impacts my decision-making. And, as a result, I’m happy to invest according to time-tested research.

So ultimately, my money mad lib might read: Investing in as many companies as possible makes me feel empowered.

Improving Your Investment Outcomes Through Diversification

The American stock market may be #1 for now. But acknowledging that other scenarios are possible – comedian Daniel Tosh’s equivalent of visiting Fiji – can help to improve your investment outcomes. The U.S. isn’t always the greatest country in the world for investing, and you’ll benefit over the long term if you act accordingly.

Thanks for listening to the Financially Well podcast.

[Editor’s note: this article reflects the transcript (which I’ve edited for clarity) of a recent Financially Well podcast episode.]

About the author: Kevin Mahoney, CFP®

Hi, I’m Kevin. I’m a financial advisor in Washington, DC. I’m also the founder of Illumint, an independent financial planning company in the District that specializes in financial planning for Millennials like you. I empower our generation with the confidence to invest an inheritance, financial gift, or extra savings. If you’re new to Financially Well, welcome – you now have access to the leading finance podcast for Millennials. I encourage you to read, watch, or listen to the ideas I’ve shared about making your money work for you. And then when you’re ready, please send me your thoughts & questions!

Kevin Mahoney, CFP®

About Me

We have choices after an investment setback. That may include tax-loss harvesting, which can help us salvage tax savings from the frustration.

Did you know that you can open a Roth IRA for a child who earns money? Not only will she learn about investing, she’ll experience compounding

You might love to save more money. But you also can work 6-12 more months before you retire, the equivalent of saving 1% more over 30 years.